Signature Annotation For Mortgage Docs

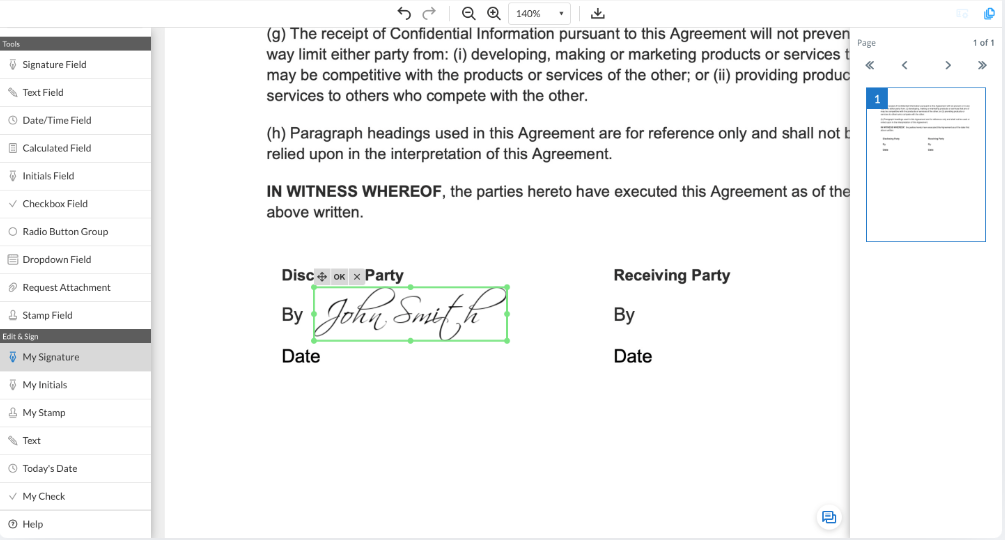

MagiQ, our advanced Ai/ML utility, swiftly identifies borrower signatures in mortgage documents within seconds and automatically tags them for seamless initial disclosures, hybrid, and full digital RON signings, revolutionizing the efficiency and accuracy of the mortgage processing workflow. Streamline your operations and elevate customer experiences with MagiQ’s cutting-edge technology.

Automate Esigning

Fast track Results

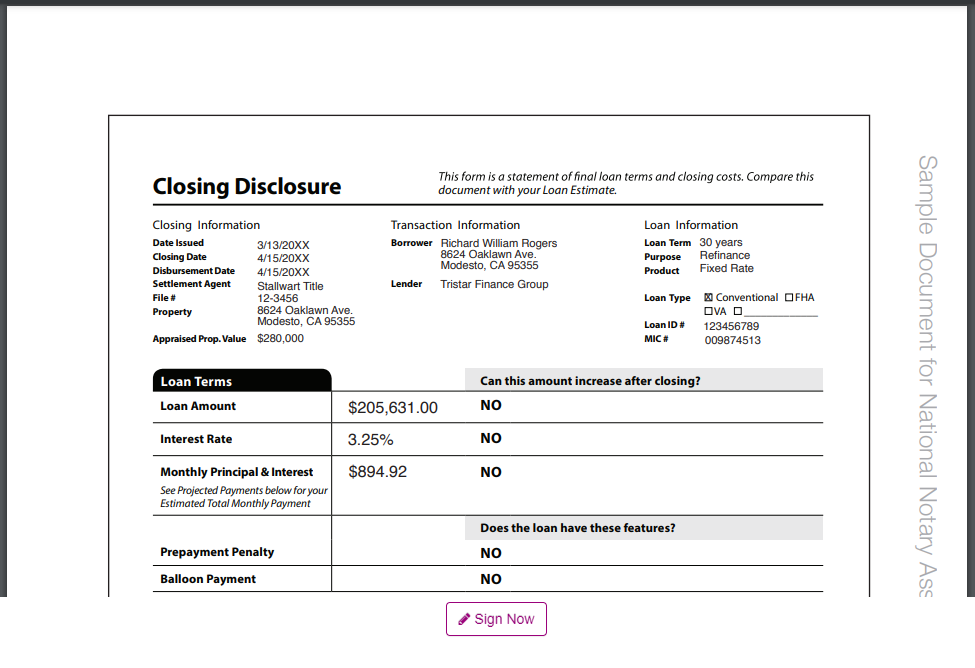

Watch as our AI tech stack automatically processes docs, tag's them for signature, sends the borrower notice of the docs, guides them through signing and even lets them schedule a notary for in person or RON closings./

Nationwide At Your Fingertips

Gone are the days of lost locks due to borrowers being in unplanned areas.

Revolutionizing Mortgage Document Processing with MagiQ Technology

MagiQ truly transforms mortgage document processing, offering a plethora of benefits that extend beyond signature detection and tagging. Its adaptability, security features, and potential for cost and time savings make it an essential tool for modernizing mortgage workflows.

01

Robust Adaptability:

MagiQ learns and adapts to different mortgage document types, formats, and styles over time, ensuring consistent performance across a wide range of scenarios.

03

Time and Cost Savings:

The speed and accuracy of MagiQ reduce manual labor, leading to significant time and cost savings for mortgage processing operations.

05

Reduced Paperwork:

With MagiQ's efficient tagging, the need for excessive paperwork and manual data entry is greatly reduced, promoting a more eco-friendly and organized approach.

07

Customer Satisfaction:

By expediting document processing, MagiQ enhances the overall borrower experience, leading to higher customer satisfaction rates.

09

Future-Proof Technology:

MagiQ's continuous learning and improvement ensure that it remains effective and relevant as the mortgage industry evolves.

11

Competitive Edge:

By leveraging MagiQ's advanced AI capabilities, mortgage businesses can gain a competitive edge by providing faster, more efficient, and error-free services to clients.

13

Competitive Edge:

Amet minim mollit non deserunt ullamco est sit aliqua do amet.

02

Enhanced Compliance:

By automating signature identification and tagging, MagiQ helps maintain compliance with industry regulations and standards, minimizing the risk of errors.

04

Seamless Integration:

MagiQ seamlessly integrates into existing mortgage software systems, making it a user-friendly addition to your workflow.

06

Data Security:

MagiQ employs top-tier security measures to protect sensitive borrower information, ensuring privacy and data integrity throughout the process.

08

Training and Support:

The MagiQ platform offers comprehensive training and support resources to assist users in maximizing its potential and resolving any queries.

10

Effortless RON Compliance:

For Remote Online Notarization (RON) signings, MagiQ's accurate tagging aids in ensuring compliance with digital notarization requirements.

12

Streamlined Audits:

The precise tagging and identification facilitated by MagiQ simplify the auditing process, making it easier to review and validate documents.

14

Streamlined Audits:

The precise tagging and identification facilitated by MagiQ simplify the auditing process, making it easier to review and validate documents.

Ready, Set, Go!

Create Account

Contact us to see a demo and setup your account

Testing and Integration

Our team will perform integration testing

Launch MagiQ!

We will deploy a turn key application that lets you annotate docs for esignings with limited hands on contact.

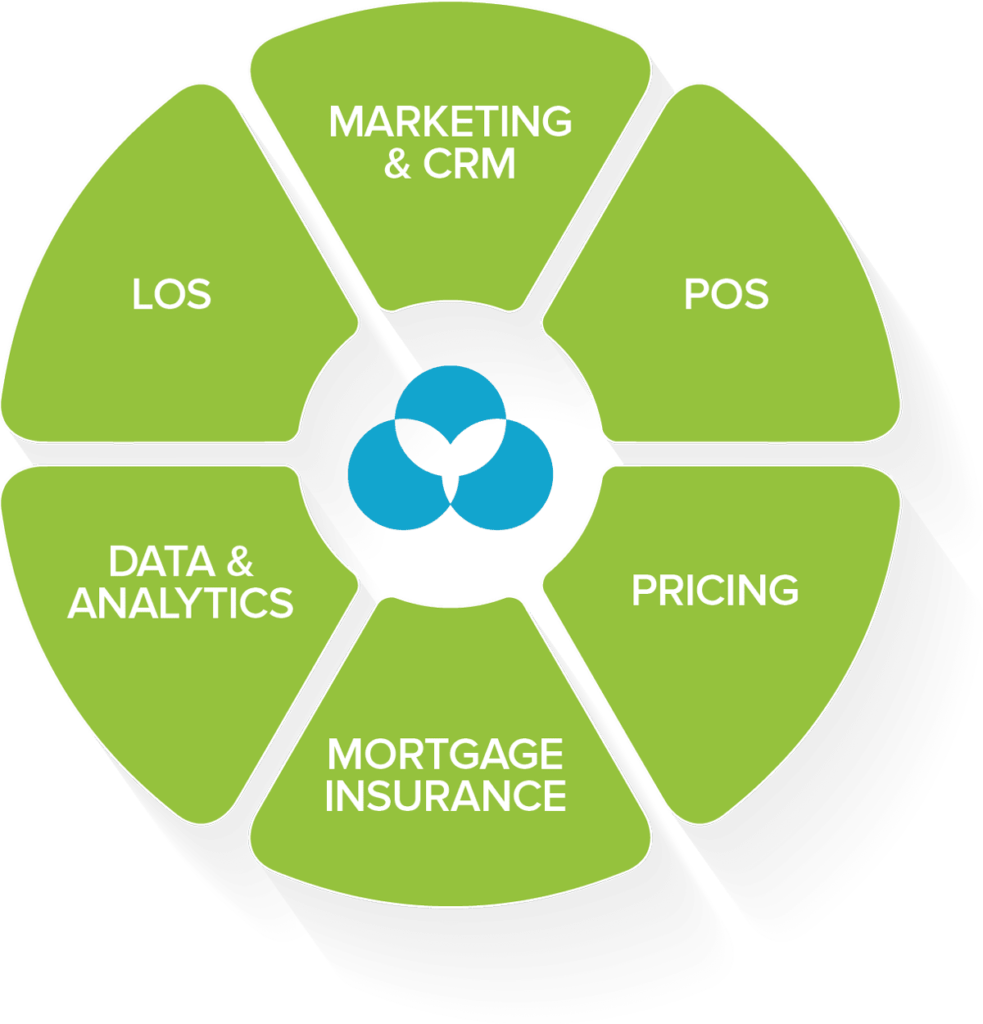

Integration's where you work

MagiQ can easily integrate with your LOS, POS or any other mortgage title software.

- Click, Connect, Go!

- Seamlessly integrate the way you work

Join our newsletter

Amet minim mollit non deserunt ullamco est sit aliqua dolor sint. velit amet suiget mullor officia. Exercitation veniam consequat sit aliqua dolor.